Starting your e-commerce website requires a lot of practical decisions, many of which will significantly affect how your business will perform in the upcoming weeks and months. One of these decisions is choosing the payment methods that customers can use to purchase goods or services from your online shop.

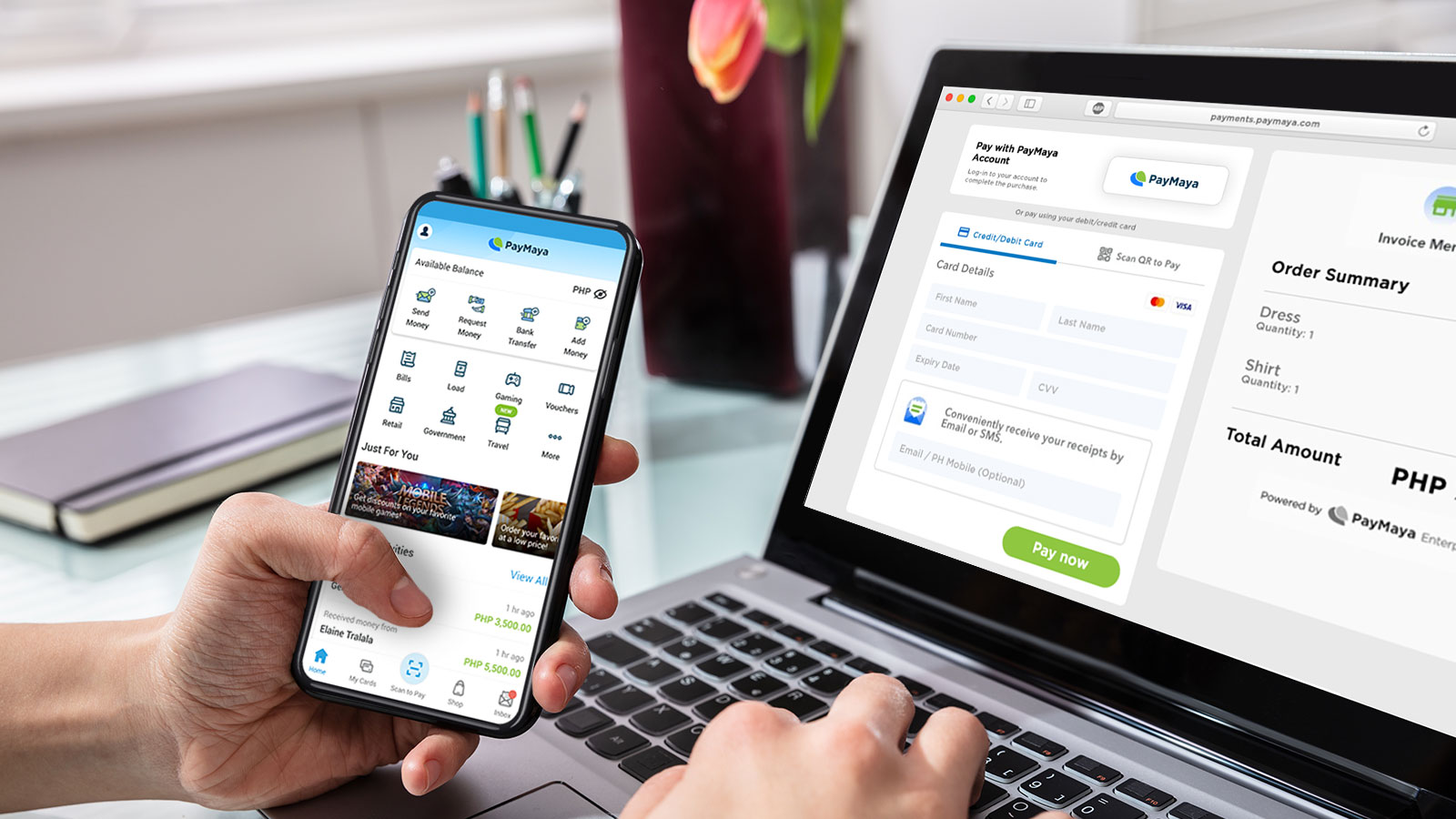

There’s no shortage of payment gateway options for the modern Filipino entrepreneur. You can choose to add various modes of payment to your website, including credit card and debit cards, bank deposits, remittance services, QR codes, and cash-on-delivery. More and more entrepreneurs and consumers are also discovering the benefits of incorporating e-wallet payment methods into their online shops. E-wallets refer to services, devices, or apps like Maya that allow users to store and transfer funds and complete their online transactions.

Having this option on your online store gives you and your customers more control over your financial transactions. Here are just some of the benefits that you can enjoy after adding e-wallets to your e-commerce website’s payment choices:

Widen Your Target Market

Debit and credit cards, bank transfers, and remittance services are more accessible than ever. However, it can’t be denied that these payment options remain out of reach to some consumers, like those who are not too familiar with their bank’s digital channels, those who live away from banks and remittance centers, and those who are simply too busy with their daily tasks. These consumers will have a difficult time completing their transactions on your website if they can’t find a payment option that suits their current situation.

E-wallets, on the other hand, are easy to set up. Users only need to download the app on their phone, create an account, and add money to their account by visiting any of the app’s partner merchants. This makes it easy for consumers to complete their purchases on your website. Now, your market can expand to include buyers who want to indulge in online shopping, regardless if they have an existing bank account or not.

Improve Customer Experience

There’s no physical interaction between a digital entrepreneur and an online shopper. As such, enabling e-wallet payments on your online store is one of the ways that you can improve customer experience on your shop’s digital platform.

Remember that one of the draws of online shopping is the level of convenience it affords consumers. Online shoppers want a hassle-free shopping experience, from finding the items they want up to getting the exact items they paid for. Giving your customers different payment options, including e-wallet payment channels, allows them to enjoy a seamless experience on your digital store. This, in turn, leaves them with a good impression of your brand, despite the fact that they’ve never interacted with you in person.

Enjoy Safer Transactions

Online transactions are now one of the safest and most convenient ways of storing and moving money. Exchanging physical bills and coins carry its own security and health risks. It would be difficult to trace bills and coins and determine their origin and who owns them, but this isn’t a problem when dealing with digital payments. It’s easy to trace payments made on e-wallets, so it won’t take a lot of time to iron out payment issues and answer questions that may come up in your day-to-day operations.

At the same time, though, there are still scams that target online shoppers and e-commerce websites. It’s best to educate yourself and your customers of these threats and implement standard safety measures for your online transactions. This way, you can avoid falling victim to these scams.

Access Real-Time Financial Data

Digital payments made through e-wallets are easy to track, and you can use this information to see the aspects of your business that can use a bit of adjustment. You can pay your utilities and government contributions through your e-wallet, and you can use your payment history to determine if you need to cut on particular expenses like electricity, water, or internet bills to reduce your overhead costs. You can also use the information from your e-wallet account to check which items are a hit with your customers and which stocks are not moving at all. Access to real-time financial data—something that is readily available in your e-wallet account—is crucial to making informed decisions for your business.

Stay on Top of New Payment Methods

Humans have been exchanging coins and bills for thousands of years, but there’s good reason to believe that we’ll soon shift to using digital money to pay for most of our purchases. Educating yourself on alternate payment methods like e-wallets as early as today will benefit your business. By staying up to date with the latest payment methods, you’re ensuring that you’ll be able to adapt to the changes in how society views and exchanges money. This, in turn, will make it easier for your business to enjoy the benefits of these new technologies.

Applying for an e-wallet account for your business is an easy and simple process. Start exploring your digital payment options today and discover how it can benefit your business in the long run.

You might also like

These Stories on Mobile Payments