Scams and fraudulent schemes have become increasingly sophisticated over the years, which has led to more Filipinos falling victim to them. In fact, according to a report by the Global Anti-Scam Alliance (GASA), a non-profit organization dedicated to increasing global awareness of scams, Filipinos have lost a staggering PHP 460 billion to scams in 2024. The report also noted that 85% of those scams were delivered via text messages. One text message scam that has highlighted how insidious scams have become today is text hijacking or spoofing, where scammers manipulate communication channels to impersonate legitimate organizations.

As the country’s leading digital bank, Maya is always looking for ways to educate our users on these scams to ensure their hard-earned money remains safe. On top of that, every Maya security measure is also engineered to ensure your digital account is safe from these cyber threats. Thus, if you’re wondering, “Is Maya safe?” then the answer is certainly yes.

To help you better understand what text hijacking is, let’s take a closer look at how text hijacking or spoofing scam works as well as the robust security measures that Maya employs to keep you safe from text scams.

What Is Text Hijacking and How Does it Work

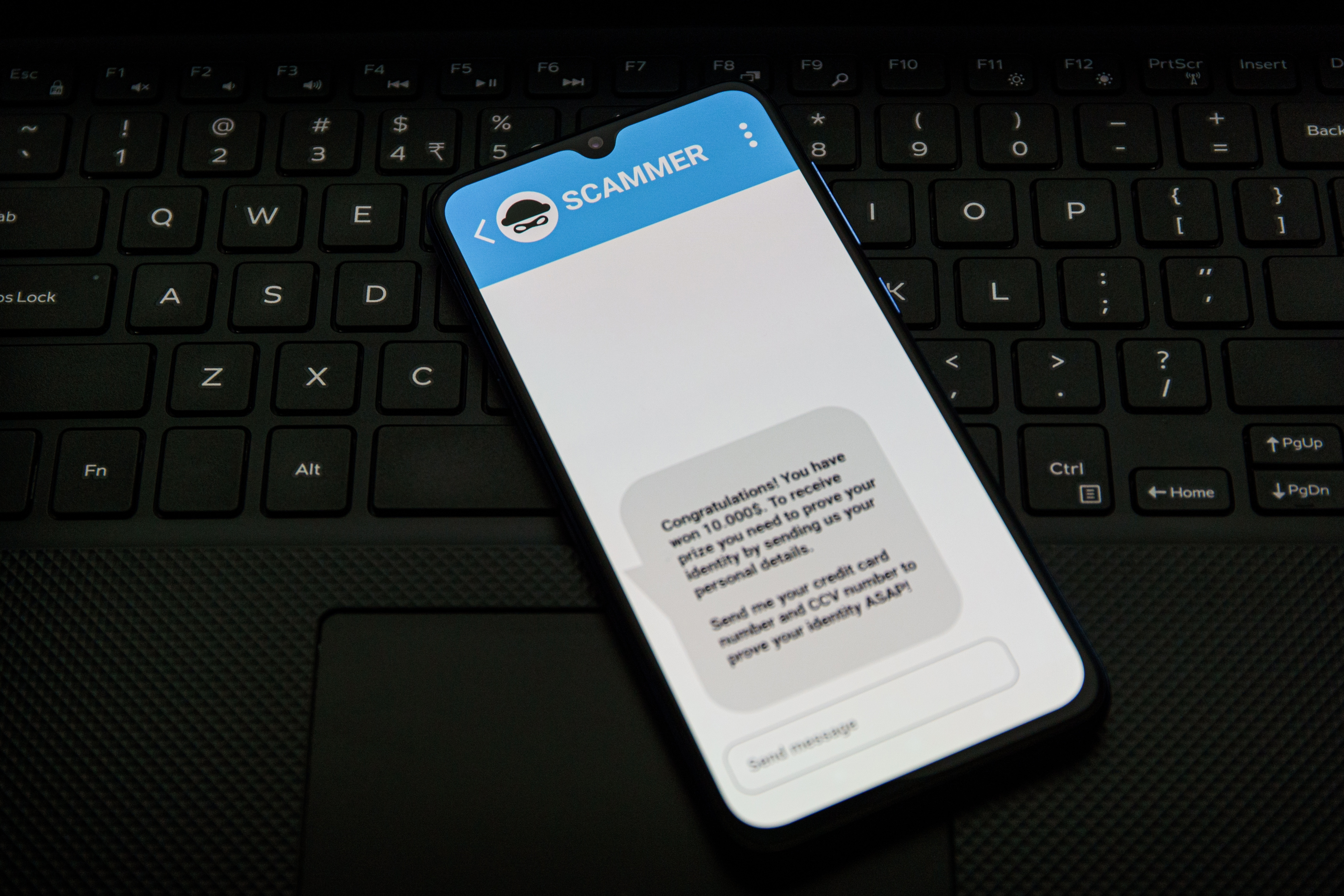

Text hijacking, also known as spoofing, is a scam where fraudsters send messages that appear to originate from trusted sources. These messages often use the very same names of banks and legitimate companies to trick recipients into revealing sensitive information or transferring funds.

What makes them more difficult to spot from other text scams is that text hijacking often involves using fake cell sites to interject their fraudulent message between the legitimate ones sent by an official company. For instance, legitimate text messages from banks often only display the bank’s name as the sender instead of a typical unbranded phone number, which is what typically gives away text message scam. A scammer doing a text hijacking scam, however, can use software to push messages directly under your bank’s name, essentially hijacking the legitimate conversation or SMS thread you have with your bank and making you think that they’re still official text messages from your bank. These messages often contain distressing alerts such as your account being compromised before prompting you to click a link where you can supposedly “verify” your identity as the account’s owner. The consequences of falling victim to text hijacking can be severe, often leading to stolen credentials and financial losses.

Tips to Protect Yourself from Text Hijacking

To avoid becoming a victim of text hijacking scams, it’s important to stay vigilant and always double-check the messages you receive even if you think they came from a legitimate source. Here are some tips to protect yourself from text hijacking and other similar scams, along with the security measures that Maya uses to keep your account safe.

1. Learn How to Spot Red Flags

Always be cautious of unsolicited messages, especially those requesting sensitive information or urging immediate action. A common red flag is that text scams use urgent language, often resorting to scare tactics such as your account or card getting blocked to pressure you into acting without thinking. Train yourself to never click on suspicious links and to evaluate the content first to determine whether it’s truly legitimate or not. If unsure, contact your bank using their official channels found on their website. Remember, Maya will NEVER send you links or ask for your app password, OTP, or other sensitive information over text or any other channels.

2. Practice Good Cybersecurity Habits

Cultivate good cybersecurity habits to avoid becoming vulnerable to scams. For instance, you should never share sensitive information such as passwords or PINs. Be extra cautious of messages that include attachments or those that request you to download apps from unofficial sources. Avoid leaving your devices unattended with your accounts logged in as well.

In addition, make sure you only use your bank or e-wallet app when connected to a secure network such as a password-protected home WiFi, especially if you’ll be sending and receiving money, paying your bills, or doing other financial transactions. Public networks such as free WiFi in malls, airports, coffee shops and other establishments are often unsecured, thus making it easier for scammers to intercept your data through them.

3. Leverage Technology

Fully utilize the security features available to you—and abide by established best practices—to safeguard your digital banking accounts. For instance, make sure to enable your phone’s biometrics feature as an added layer of security. Moreover, never root or jailbreak your phone as it could lead to compatibility issues with your banking apps, or worse, you could experience catastrophic security issues.

Maya takes things further by enforcing measures that ensure only the real user can access their banking and wallet accounts. When a user logs in to a new device, Maya doesn’t use the phone's native face ID or biometrics features. Instead, it uses its own in-app face authentication feature that captures the face of the user and compares it with the submitted IDs of the account. This ensures maximum account security for the account owner. Maya also requires OTPs for big transactions, which include transferring money to other banks and e-wallets, applying for credit and loans, and payments via QR Ph. This acts as a powerful barrier against fraud attempts, thus keeping your funds safe.

4. Report Suspicious Activity

If you receive any suspicious text messages, especially those impersonating Maya, report them directly to us through our 24/7 in-app support. We will handle the escalation to law enforcement agencies, primarily through our partnership with the Philippine National Police (PNP), to take appropriate action against fraudsters.

5. Educate Yourself

Scammers can change their tactics and adapt over time. Thus, it’s important to always stay informed about the latest scams by reading news alerts or updates from trusted sources. Maya makes this easier by occasionally sending in-app advisories and security tips so you can always stay one step ahead of scammers.

Understanding what text hijacking or spoofing allows you to reduce your risk of falling victim to these scams and thus keep your banking and e-wallet accounts safe. With your vigilance combined with Maya’s advanced security measures, you can confidently accomplish your digital transactions and safeguard your financial well-being at the same time.

You might also like

These Stories on Maya