Contactless payments, in the way that it’s being promoted and used in the Philippines today, might seem like a brand new technology. However, the anchoring technology has already been in use since the late 1990s. In particular, Busan, South Korea began to implement the Hanaro Card, a contactless smart card, for their public transportation system in 1997. In February 1998, the Hanaro system was fully adopted by Busan and thus became the first integrated smart payment system in the world.

By the early 2010s, millions of people all over the world have already gotten used to going cashless. To further encourage familiarization and usage, Samsung, Google, and Apple have incorporated mobile wallets in most of their mid- to flagship-tier phones.

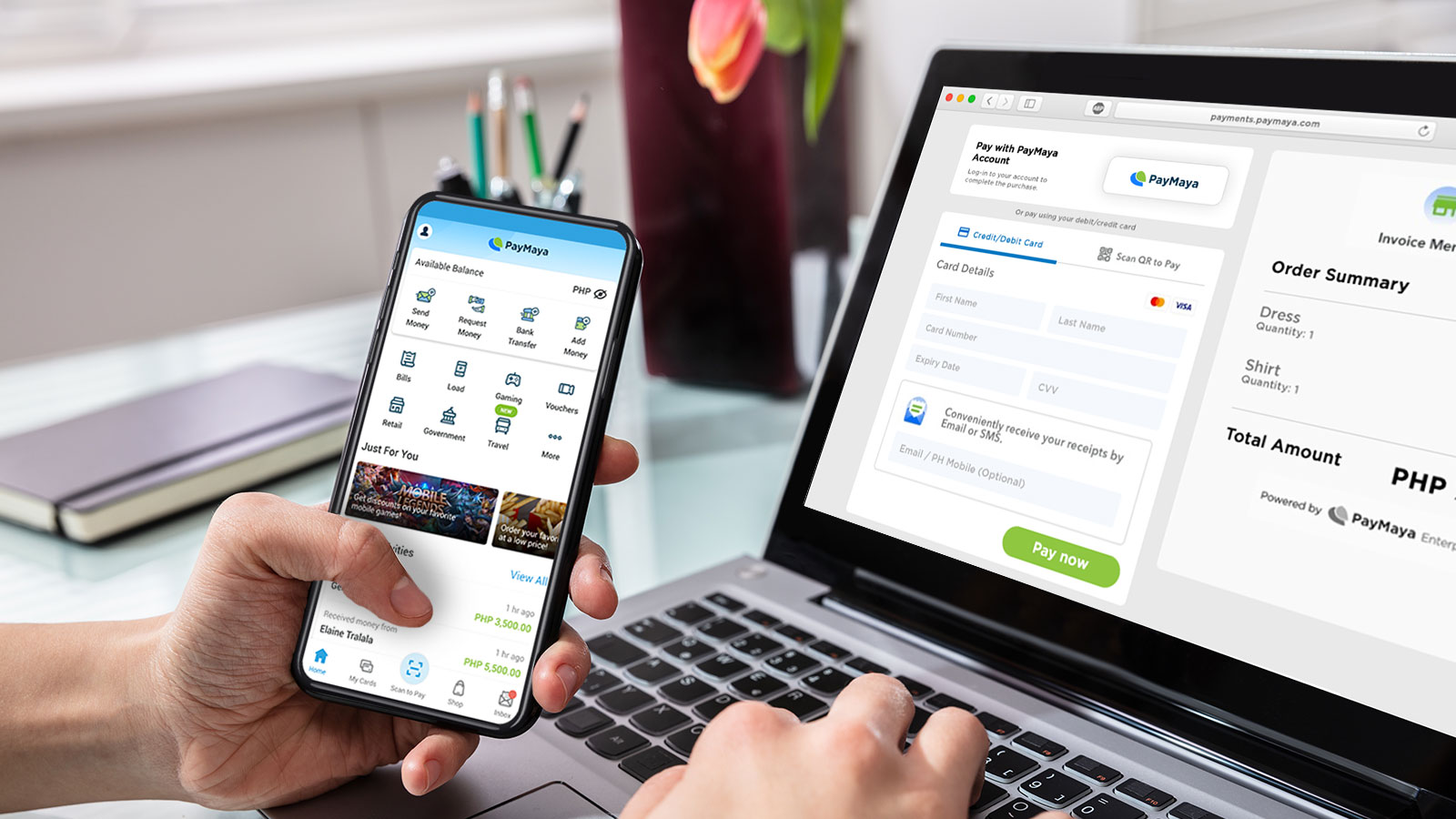

Locally, contactless payment systems have been launched as early as the 2000s, when pioneering companies introduced the service around 2004 to 2007. However, the Philippines has been generally slow in adopting e-wallets and other forms of contactless payment solutions. It was only during the mid-2010s that usage picked up. As of 2018, Maya (and Smart Money) has reported a combined 8 million active users. Other providers have similarly reported user base growth in the past five years.

Contactless Payments in the Philippines Today

Recent studies have shown that Filipinos are “generally interested” in going cashless. Due to the effects of the COVID-19 pandemic, it’s expected that contactless payments will become even more popular. Aside from debit and credit cards, mobile banking apps as well as mobile and e-wallets are predicted to enjoy a surge not just in user numbers but also usage frequency.

It has to be noted that cash remains to be the most common payment method in the country. Nevertheless, research has shown that many Filipino consumers have already tried contactless payment methods. This likelihood increases further if the consumer is already a user of traditional credit cards. In addition, studies have noted an increase in contactless payment usage in 7 out of 10 Filipinos compared to two years ago. Convenience and speed are two primary reasons behind the interest and willingness to give contactless payments a go.

A huge chunk of cashless transactions in the Philippines is made in the retail sector. This is largely fueled by e-commerce. Many online marketplaces and even individual retailers have incorporated various cashless payment options, including e-wallets. Aside from online shopping, Filipinos also use contactless payments and cashless solutions for the following:

Paying Bills

Bills payment is perhaps neck and neck with online shopping as the number one function of contactless payments for Filipinos. Most if not all primary utility providers—such as electricity, water, telecommunications, and internet companies—have agreements with e-wallets and banks as payment partners.

There are also other types of bills such as tuition fees, real estate payments, and even insurance premiums that you can pay through contactless methods. Finally, government payments such as taxes and contributions can also be paid using mobile or e-wallets, banking apps, as well as debit and credit cards.

Grocery Shopping, Deliveries, and Eating Out

Many supermarkets, restaurants, and other retail establishments have also adopted contactless payment solutions in most or all of their branches. One of the most popular methods is through QR codes, where customers simply scan to pay. This further speeds up the process, since there’s no need to swipe a card. It also further minimizes person-to-person contact, since the only step required is for the customer to scan QR code using their smartphone.

Sending and Receiving Money

Contactless payment solutions are also handy when it comes to sending money not just in the Philippines, but also around the world. Mobile banking apps already have this feature, although some banks require their account holders to pre-enroll transferee accounts. However, some consumers prefer using e-wallets or mobile wallets because they allow money transfers to banks as well as other e-wallet or mobile wallet accounts. This is definitely a boon, especially for unbanked Filipinos.

Another reason that e-wallets and mobile wallets are popular is that there are multiple ways to add money, such as through banking apps, convenience stores, and even pawnshops.

Buying Load and Mobile Data

Mobile banking apps and e-wallets are two of the most popular contactless solutions that let consumers buy mobile prepaid load. You can do this for your own mobile number, or send the load as a gift to another user. What’s great is that buying prepaid load through contactless payment solutions is cheaper and available for any mobile network. Some e-wallets like Maya also allow you to buy mobile data credits. Like prepaid load, you can also purchase mobile data for any telco through contactless payment solutions.

Claim Remittances

For those with OFW relatives who need to claim remittances, contactless payment companies also provide this service. This is usually done through a remittance partner, where you have to input a transaction number. Once verified, the remittance amount will then be credited to the e-wallet or bank account. Depending on the company or bank and the remittance partner, the money will either be instantly available or credited after a few banking days.

Do note that the previous points are not the only features available in many contactless payment solutions. Some e-wallets, for example, also allow users to buy gaming pins for use in mobile, PC, and console games. It’s also noteworthy that, oftentimes, it’s the frequency of usage and not the amount per transaction that makes these payment solutions thrive in the Philippines.

In addition, some contactless payment solutions in the country combine offline and online elements. This works for the benefit of unbanked Filipinos, who can go to convenience stores and other partners to add or withdraw money from their accounts.

It’s fair to say that the Philippines has the potential to go largely cashless. Many users of contactless payment solutions are either using them exclusively or using them in tandem with other payment methods. The confidence in using e-wallets and other cashless solutions is also increasing.

Reasons for Choosing Contactless Payments

As earlier mentioned, convenience and speed are two of the primary reasons that Filipinos opt for cashless payment options. Lining up at banks or payment centers takes a lot of time, which still doesn’t include the time you spend to actually get to the destination. Then there’s the tedium of filling out forms, which is not just time-consuming but also less eco-friendly.

Other reasons that encourage more Filipinos to use contactless payment solutions include the following:

Security

Using contactless payment solutions means your personal information cannot be copied or stolen. When you scan a QR code, for example, all you need to do is open the corresponding app and the payment will already push through. For cards, the EMV (Europay, Mastercard and Visa) chip is already a standard. This is much safer than the old cards which only feature magnetic stripes, which can be easily scanned and copied.

Health

Money changes hands multiple times each day. This simply means that they can get quite dirty and laden with viruses and bacteria. With the global health emergency triggered by COVID-19, this is definitely not an ideal scenario.

With contactless payment systems, you minimize the risk of getting exposed to such harmful pathogens. What’s more, you also minimize the risk of passing on the pathogens to workers (such as cashiers or waiters) who handle your money.

Money Management

When you use cashless payment solutions, it’s easier to keep track of your expenses. Each purchase or payment will come with an electronic receipt, which gets saved in your account. You can also take a screenshot of the e-receipt, if you want, for further documentation.

With such easy access to your transactions, you can easily monitor where your money goes. This, in turn, can help you become better in managing your money. It can even help you save more money. In addition, getting e-receipts instead of paper ones reduces your carbon footprint. This is a good way to start a more eco-friendly lifestyle.

The Future of Contactless Payments in the Philippines

Seeing the current landscape of contactless payments in the country, it’s now time to explore its future potential. Below are just a few possibilities as the Philippines moves toward the future of financial technology.

Contactless Payments Will Be More Popular Than Cash

This is a huge challenge for the Philippines, but it’s not entirely impossible. The key things to address are internet infrastructure and trust. Some people can’t use contactless payment solutions because of unreliable signal strength. Trust is also a huge barrier to overcome, especially with regards to privacy and data security. Once these problems are addressed, it will be easier to convince people to make the switch.

For areas like Metro Manila where the adoption rate is already high, it’s only a matter of time that contactless payment solutions overtake cash. COVID-19 has made us more aware of just how dirty (literally) physical money can be, which in itself can be a huge motivator to go cashless. There are also tech enthusiasts, who have gained huge followings over the years, who continue to tout the benefits of going cashless. This can further influence those who are on the fence about going cashless.

Contactless Payments May Be Seen on the Streets More

If you’ve been on social media lately, you’ve probably seen donation drives where monetary contributions can be coursed through contactless payment systems. There are also heartwarming photos that show street vendors who are already accepting payments through e-wallets to help practice physical distancing.

The advantage of contactless payment systems, particularly e-wallets like Maya, is that it’s easy to make an account. This makes them more user-friendly, especially to unbanked Filipinos and those with limited technical knowledge. Thus, it’s not entirely impossible to see more sari-sari stores and street vendors use QR codes and other contactless solutions in the future.

Contactless Payments May Replace Credit Cards

“Replace” here is not meant to be taken literally. Instead, contactless payments may be used to perform many of the functions that credit cards serve. This includes scheduling bill payments, shopping online (which is already happening), and spending money abroad.

It’s important to take note of factors affecting credit card adoption and usage in the country. For example, many contactless payment solutions, particularly e-wallets, have fewer and less strict requirements. Contactless payment systems are also relatively safer. If all security measures are activated, such as biometrics and two-factor authentication, contactless payment fraud rates can be as low as less than 1%.

Contactless Payments Can Make Cryptocurrency Mainstream

The Philippines is considered a cryptocurrency-friendly country. In 2017, it was estimated that about 2 million Filipinos received varying levels of exposure to crypto. Nevertheless, the adoption rate remains low. Moreover, the concept of crypto-as-payment hasn’t taken off just yet.

These can be attributed to the volatility of cryptocurrency. Filipinos work hard to earn and it’s a huge risk to invest their hard-earned money in something that’s so unpredictable. Those with money to spare, on the other hand, can be dissuaded by the limited channels with which to invest.

As digital and contactless payments become the norm, however, it will likely become easier to invest in cryptocurrency. Indeed, there are already apps that allow you to monitor and invest in the stock market. If the trend continues, it will be a matter of when and not if with regards to the more widespread adoption of cryptocurrencies.

There was a time when going cashless was only considered as something for the “elite.” However, as fintech companies work toward expansion and accessibility, this is no longer the case. Indeed, with the way things are going, it’s safe to say that contactless payment solutions will continue their growth in the coming years.

As earlier mentioned, there may be some barriers that have to be broken down. On the other hand, technology has become more widely available and affordable throughout the years. This, along with the easily appreciable benefits of going cashless, can help with the widespread adoption of contactless payment systems. All that remains to be seen are the speed at which the Philippines adopts and innovates the technology.

References

- https://business.inquirer.net/296510/visa-philippines-study-shows-filipinos-are-ready-to-go-cashless

- https://www.hpe.com/us/en/insights/articles/five-predictions-for-the-future-of-contactless-payment-2005.html

- https://revelsystems.com/blog/2020/05/14/contactless-technology/

- https://www.practicalecommerce.com/covid-19-nfc-and-the-future-of-contactless-payments

You might also like

These Stories on Mobile Payments