The way Filipinos manage their money has changed dramatically in recent years. With the rise of cashless payments and online banking, more people are shifting from traditional and physical financial tools to digital alternatives. Ewallets and digital banks, in particular, have gained widespread popularity because they give users a faster, more convenient way to handle their finances. While these two financial solutions may seem interchangeable at first glance, they serve distinct purposes—and understanding their differences can help individuals make the most out of both.

Though it began as an ewallet app known as Paymaya, Maya has since become a unique hybrid that stands out in the Philippines’ financial landscape. Unlike some popular e-wallet apps that operate separately from digital banks, Maya integrates both within the same ecosystem. This means any user can enjoy easy digital transactions through their Maya e-wallet while also taking advantage of Maya Savings, Maya Time Deposit Plus, and other financial products—all within one secure, BSP-regulated platform. With the “safety of a bank and the convenience of a wallet,” Maya ensures that users don’t have to choose between flexibility and security.

To better understand the distinctions between digital banks and e-wallets in the Philippines—and how Maya provides the best of both worlds—let’s take a closer look at their key differences.

Services Offered

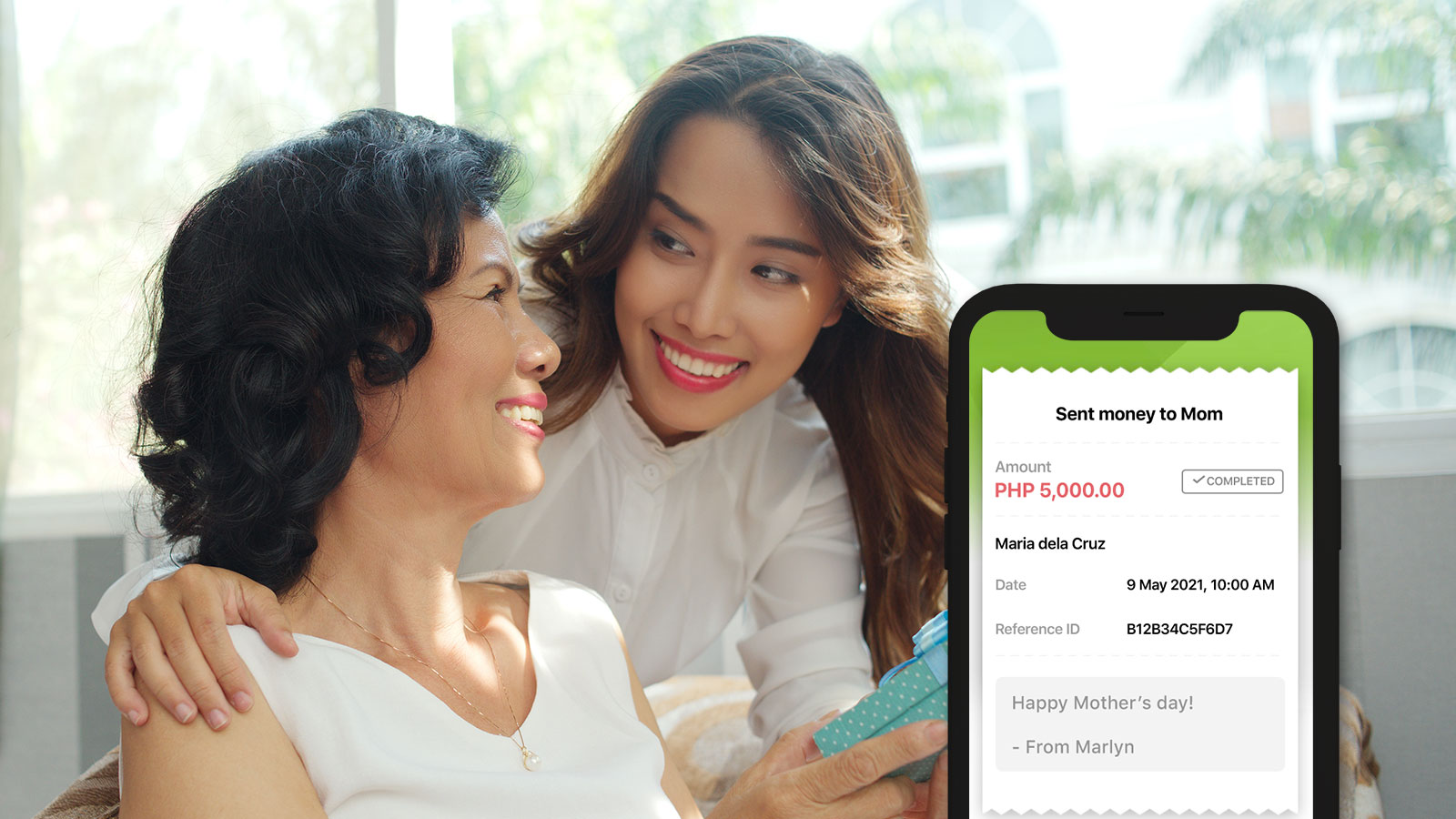

When you need to split a restaurant bill with friends or pay for an online purchase, an e-wallet is a go-to option. These platforms are built for fast, seamless transactions, as they allow users to send and receive money instantly, scan QR codes for payments, purchase mobile load, and pay bills. Some even offer additional features, like virtual debit cards, cashbacks, and limited credit options.

Digital banks, on the other hand, go beyond everyday transactions. They function like traditional banks but without physical branches, so you’ll find savings accounts, time deposits, loans, and investment options available in their roster of services. These institutions cater to users who want to grow their money rather than just move it around. Maya, in particular, has risen to become the #1 digital bank in the country, so its services easily go toe to toe with those of more established financial institutions.

Interest Rates and Deposits

The difference between e-wallets and digital banks becomes even clearer for those looking to grow their savings. Most e-wallets do not offer interest on stored funds—they’re primarily designed for spending, not saving. While some e-wallets partner with banks to offer savings accounts, these accounts are technically separate from the wallet itself, so they typically require additional steps to access and manage funds.

Digital banks, however, specialize in deposit-taking and wealth-building, as they offer higher interest rates than traditional banks. Many digital banks in the Philippines provide 3% to 6% annual interest, significantly more than the near-zero rates found in traditional savings accounts. Maya, for example, offers a highly competitive base interest rate of 3.5% on Maya Savings account, with the chance to boost it up to 15% p.a. by performing everyday transactions through the Maya app.

Regulation

Behind the scenes, e-wallets and digital banks operate under different sets of regulations. E-wallets are classified as Operators of Payment Systems (OPS) under the Bangko Sentral ng Pilipinas (BSP), which means they facilitate payments but do not function as full-fledged banks. Their primary role is to process transactions quickly and efficiently, but they are limited when it comes to deposit-taking, lending, and other core banking services.

In contrast, digital banks are fully licensed financial institutions regulated under stricter BSP guidelines. They must adhere to the same compliance measures as traditional banks, including capital requirements, consumer protection policies, and risk management protocols. Because they’re so strictly regulated, digital banks offer greater financial security and stability than standalone e-wallets.

Accessibility and Security

One of the biggest draws of e-wallets is how easy they are to access. Setting up an e-wallet account is often as simple as downloading an app and registering with a mobile number. While full verification (Know Your Customer or KYC) unlocks more features, users can typically start transacting with minimal requirements.

Digital banks, in contrast, require stricter verification procedures before allowing users to open accounts. This is because they follow the same security protocols as traditional banks, including identity verification, anti-money laundering (AML) compliance, and fraud protection measures. While this may seem like an extra step, it’s what enables stronger security and regulatory oversight compared to standalone e-wallets.

Main Use Cases

E-wallets and digital banks aren’t in competition—they simply serve different financial needs. E-wallets are best suited for everyday transactions such as shopping, paying bills, sending money, and purchasing mobile load. They’re designed to be quick and convenient, making them ideal for small, frequent payments.

Digital banks, on the other hand, are more suited for long-term financial management. If the goal is to save, earn interest, apply for loans, or access banking services, a digital bank is the better option. Their high-yield savings accounts and financial tools help users grow their wealth rather than just facilitate transactions.

As mentioned, some platforms, like Maya, combine the best of both worlds—offering the convenience of an e-wallet alongside the benefits of digital banking. Users can seamlessly switch between spending and saving, taking advantage of features like high-interest savings accounts, credit options, and investment tools, all within a single app. This hybrid model provides greater financial flexibility, allowing users to manage both their day-to-day expenses and long-term financial goals without needing multiple platforms.

As digital finance continues to evolve in the Philippines, understanding the distinct roles of e-wallets and digital banks can help users manage their money more effectively. Instead of choosing one over the other, why not experience the best that each one has to offer With Maya being a secure, BSP-accredited digital bank that also offers seamless e-wallet services, you’re sure to get plenty of convenient, rewarding ways to both spend and save—all in one app.

You might also like

These Stories on E-Wallet