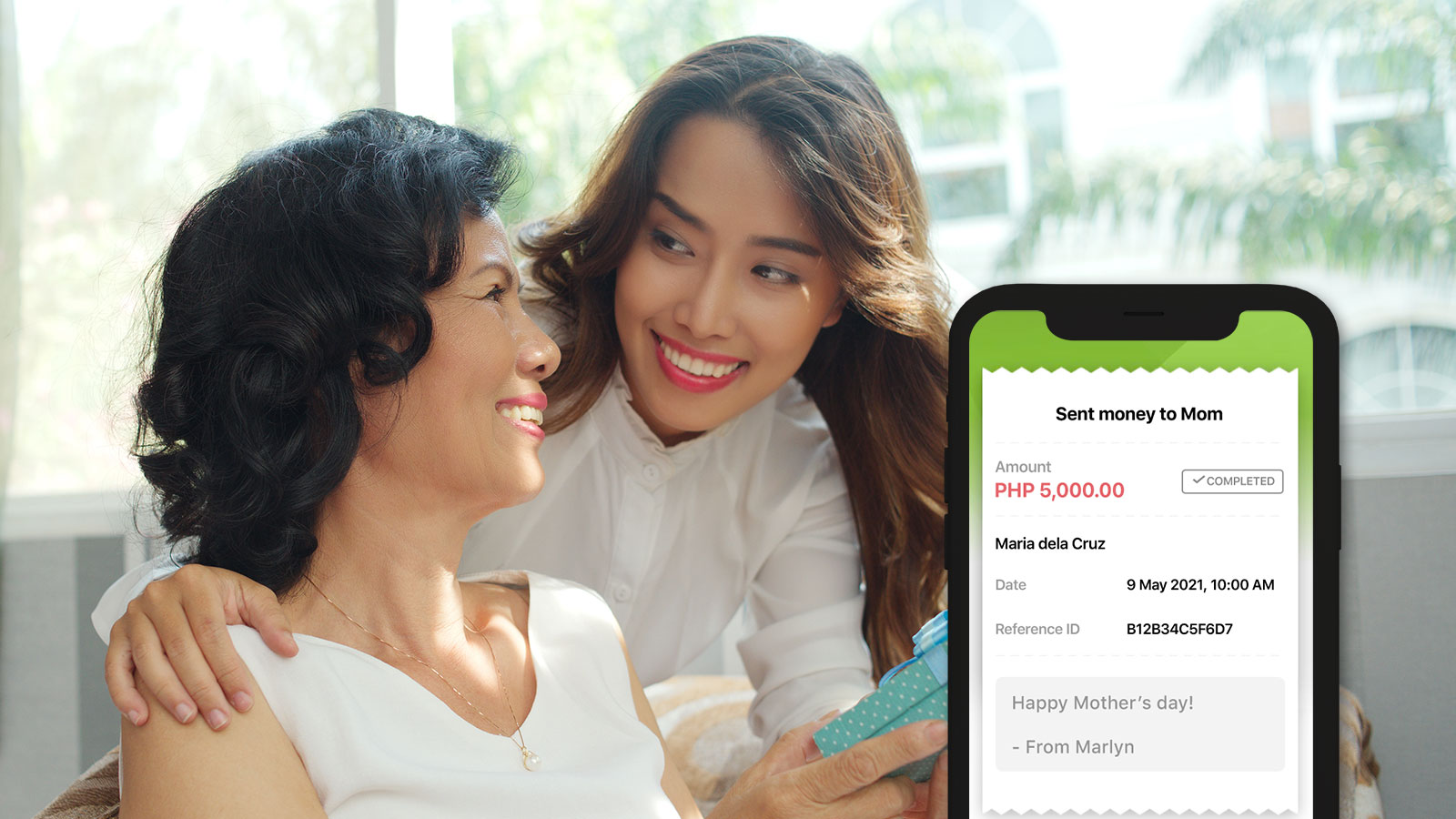

One of the biggest reasons behind the surge in popularity of mobile wallets is convenience. Just one app can let you send and receive money, pay your bills, as well as purchase mobile prepaid load, among many other functions.

However, because all of these transactions are conducted online, there are also different kinds of threats that you have to deal with. These include online scams and hacking, which can compromise your privacy and your financial information.

Luckily, it’s easy to keep your mobile wallet safe and secure from cybercriminals. Here are just a few best practices that can help you protect your account:

Don’t Give the OTP to Anyone

When you conduct transactions using your mobile wallet, you will be sent an OTP or one-time password through your registered mobile number. The OTP is like a verification code to make sure that it’s really you who made the transaction. If you are able to input the OTP, then it means that you’re in possession of your device and have proper access to it.

If someone gets in touch with you asking for your OTP, don’t give it. Remember: you’re supposed to receive the OTP and then input it yourself. If someone gains access to your mobile wallet account somehow, you can still stop fraudulent transactions if you don’t give your OTP.

Learn the Signs of Phishing

Phishing is a popular cybercrime technique. Hackers and cybercriminals use a variety of tactics to trick you into providing personal information, which they can then use to steal important data. Thus, learning how to spot phishing emails and texts is crucial in protecting your mobile wallet.

One of the most common signs of a phishing scheme is that it’s trying to scare you or make you feel alarmed. For example, cybercriminals will tell you that your account is locked because someone made a purchase worth thousands of pesos. Then, to “reactivate” your account, they will ask for your personal details or ask you to log-in using a suspicious link.

Another common phishing tactic is the promo or contest scam. Someone will contact you to tell you that you’ve won a luxury prize, even if you haven’t even joined a promo or contest. Another red flag would be grammatical and spelling errors in an official email or text. Legitimate companies don’t make these kinds of mistakes.

Protect Your Mobile Device

Your smartphone is a powerful device. You can use it for watching videos and playing games, as well as boost your productivity at work. Despite its amazing capabilities, however, your smartphone is still vulnerable to cyberattacks.

Thus, you need to be proactive in protecting your device. One good way to do this is to not connect to public Wi-Fi networks. These connections are easier for hackers to get into, which can severely compromise your privacy.

You should also use strong passwords to lock your phone (no, “password1234” is not a strong password). Moreover, you should have different passwords or PINs for your different mobile apps. Finally, it’s a good idea to change your passwords from time to time. If you’re having trouble remembering everything, you can use a password keeper to help you keep track.

Don’t Download Random Apps

It’s tempting to install different kinds of apps on your phone, particularly games or perhaps photo enhancement tools. However, you need to be careful about the things you download. These apps can be used to spy on everything that you do and even access your personal details.

Make sure to read and understand the terms of service before you click that “Agree” button. Better yet, don’t download apps left and right. Take stock of how you use your smartphone and only install apps that will truly be useful to you. Of course, it’s also a good idea to check if the app is made by a trusted developer.

Use QR Codes

QR or quick-response codes, which often look like squares with black-and-white patterns, are one of the most popular cashless payment solutions. All you have to do is point your phone’s camera to the QR code and the information of the recipient will be captured. You can also generate your own QR code that you can give to others so they can transfer funds.

Using QR codes for mobile wallet transactions not only helps minimize errors. It also helps improve security because its contents can’t be changed once it’s generated. Even if you’re using a dynamic QR code, you can only change the contents if you have access to the user account. This won’t be an issue if you’ve taken steps to protect your mobile device (see previous tips).

Transact Only with Verified Sites

Last but not the least, one of the most effective ways to protect your mobile wallet is to transact only with verified sites. This is especially true if you’re fond of online shopping. Don’t just give away your details on an unsecured merchant website. Check the URL and verify if they are using a trusted payment portal. If not, it’s best to stop the transaction and look for more reliable sellers.

When your mobile wallet—and your online accounts, in general— are safe and secure from cyberattacks, you’ll have more peace of mind. Follow these tips to get started!

You might also like

These Stories on E-Wallet